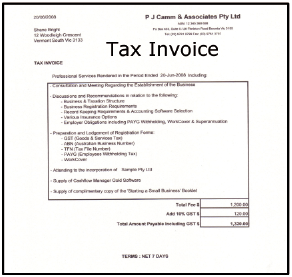

Question 6 - Do I Have To Include GST On My Invoices?

You

only need to register for GST with the Australian Taxation Office (ATO) if

only need to register for GST with the Australian Taxation Office (ATO) if

- Your annual turnover/revenue exceeds $75,000 per annum (or $150,000 per annum for non-profit organisations)

- You provide taxi or limousine travel for passengers (including ride-sourcing) regardless of your GST turnover – this applies to both owner drivers and if you lease or rent a taxi

- You want to claim fuel tax credits for your business or enterprise.

OTHER QUESTIONS IN THIS SERIES:

- What Steps are Involved in Starting a Business?

- Do I Have to Register for GST?

- What Tax Records Do I Need to Keep for My Business?

- What Is a Business Activity Statement?

- What’s the Difference Between an ABN and an ACN?

- What Software do You Recommend for My Start-Up Business?

- How Much Tax Do I Pay?

- Can I Claim my Motor Vehicle Expenses?

- What Do I Need to Do When I Employ My First employee?

- What's The Most Appropriate Tax Structure For My Business?

- Are You Small Business Experts?

- How Much Do You Charge?

- How Do I Change Accountants?

.jpg)