Question 12 - Are You Small Business Experts?

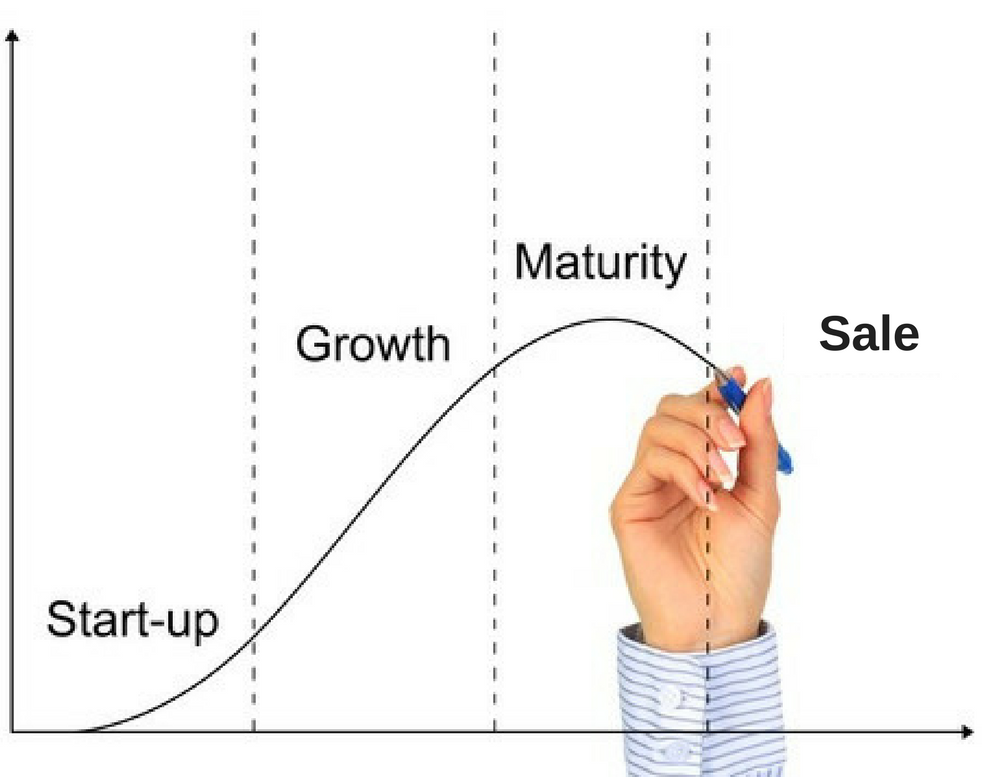

Having mentored so many business owners from start-up right through to succession and sale we have earnt a reputation as business experts. In a number of cases we have helped these clients turn an idea into a multi-million dollar asset and ‘your success is our success’.

When starting or buying a business there are numerous issues to consider. It can be a minefield but as business start-up specialists we can assist you with everything from your branding through to your business structure, site selection, commercial lease, corporate brochure, marketing plan and website. We have developed a number of tools specifically for new business owners including a comprehensive checklist of start-up expenses that you can download from the resources section of our website.

We will proactively guide you through the compliance maze of GST, BAS, PAYG and superannuation and advise you on the most appropriate tax structure for your business. We’ll make sure you are using the right accounting software program for your business that best matches your business needs with your level of accounting skill. Where required, we will train you or your staff to use the software because historically many business owners in this country purchase accounting software beyond their business needs and level of accounting skill. This leads to ‘computerised shoebox’ records and extra accounting costs which conflicts with our mission of helping you minimize the cost of compliance. We are an advocate for cloud accounting solutions and work with a number of programs including MYOB, Xero and Cashflow Manager.

Our services to small business owners are both broad and deep. We can assist you with your commercial property lease and also help you source funding by chattel mortgage or lease for your new vehicles and equipment. Not only that, through an affiliate, you also have access to fleet pricing on new cars that could save you thousands of dollars.

We strive to help you ‘know your numbers’ and that includes understanding the four ways to grow your business. Once you

understand the key profit drivers in your business we can talk you through profit improvement strategies and even quantify the profit

improvement potential in your business. Of course, this is just the beginning because as accountants we can prepare some ‘what

if’ scenarios so you know your best and worst case financial scenarios. Preparing a cash flow budget and projecting your profit and

loss is all part of our service offering and we use industry benchmarks to analyse and compare the relative performance of your business

against your peers so you understand what is working in your business and what needs working on.

Situated in Canterbury around 20 minutes drive east from the Melbourne CBD, our clients span a wide range of industries and over time we

have developed considerable expertise with some specific niche industries such as:

- Primary Producers

- Abattoirs

- Panel Beaters & Smash Repairers

- Audiologists

- Laundromats & Coin Laundries

- Restaurants & Cafes

- Retailers

This industry knowledge together with our specialist services (self-managed

superannuation,

and negative gearing) have the potential to give you a serious

competitive edge.

Our

clients span the entire business life cycle, from start-up right through to sale and having mentored hundreds of business owners through

the start-up phase we have earned a reputation as business start-up

specialists.

Along the way we have developed a range of tools, templates and checklists to help fast track your business success. Our client brief

includes helping you cut the time and cost of associated with bookkeeping and tax compliance and we support a range of accounting software

programs including cloud based solutions like Xero, MYOB

Essentials and QuickBooks Online. We believe, better quality records reduce our time and your costs so together we can spend more time

working ON your business and your marketing.

Our

clients span the entire business life cycle, from start-up right through to sale and having mentored hundreds of business owners through

the start-up phase we have earned a reputation as business start-up

specialists.

Along the way we have developed a range of tools, templates and checklists to help fast track your business success. Our client brief

includes helping you cut the time and cost of associated with bookkeeping and tax compliance and we support a range of accounting software

programs including cloud based solutions like Xero, MYOB

Essentials and QuickBooks Online. We believe, better quality records reduce our time and your costs so together we can spend more time

working ON your business and your marketing.

Here at JTU Accounting Group we view your tax return as the start of the client process, not the end. Our strategic advice and practical business solutions are designed to help you build a more profitable, valuable and saleable business. No job is too big or too small for our dedicated team of accountants who are committed to ongoing professional development so you enjoy access to the best technical tax, accounting and marketing advice available. While we have a small firm personality, we have big firm capabilities.

Our services to business owners include:

- Start-Up Business Advice

- Advice and Establishment of Your Business Structure

- Advice & Assistance with the Purchase or Sale of your Business

- Spreadsheets and Tools including a Start Up Expense Checklist, Cash Flow Budget Template and Business Plan Template

- Tax & Business Registrations including your ABN, TFN, GST, WorkCover etc.

- Preparation of a Business Plan, Cash Flow Forecasts and Profit Projections

- Accounting Software Selection and Training – Bookkeeping, Invoicing, Payroll etc.

- Preparation of Finance Applications for Banking Institutions

- Site Location and Advice Regarding your Commercial Lease

- Preparation and Analysis of Financial Statements

- Bookkeeping and Payroll Services

- Tax Planning Strategies

- Industry Benchmarking and KPI Management

- Marketing Advice including branding, brochures, website and social media strategies

- Advice and assistance with the Development, Content and Website SEO

- Wealth Creation Strategies, SMSF’s and Retirement Planning Services

- Vehicle & Equipment Finance (Lease & Chattel Mortgage)

- Advice regarding Employee Relations and Workplace Laws

- Advice regarding Claiming Motor Vehicle Costs

- Business & Risk Insurances

- Business Succession Planning

In summary, if you're an ambitious business owner looking to boost your current results or if you're looking to get your business off to a flying start we invite you to contact us today. You can expect practical business, tax, marketing and financial advice that could have a profound effect on your future business profits.

OTHER QUESTIONS IN THIS SERIES:

- What Steps are Involved in Starting a Business?

- Do I Have to Register for GST?

- What Tax Records Do I Need to Keep for My Business?

- What Is a Business Activity Statement?

- What’s the Difference Between an ABN and an ACN?

- Do I have to include GST on my Invoices?

- What Software do You Recommend for My Start-Up Business?

- How Much Tax Do I Pay?

- Can I Claim my Motor Vehicle Expenses?

- What Do I Need to Do When I Employ My First employee?

- Whats The Most Appropriate Tax Structure For My Business?

- How Much Do You Charge?

- How Do I Change Accountants?

.jpg)